Trending

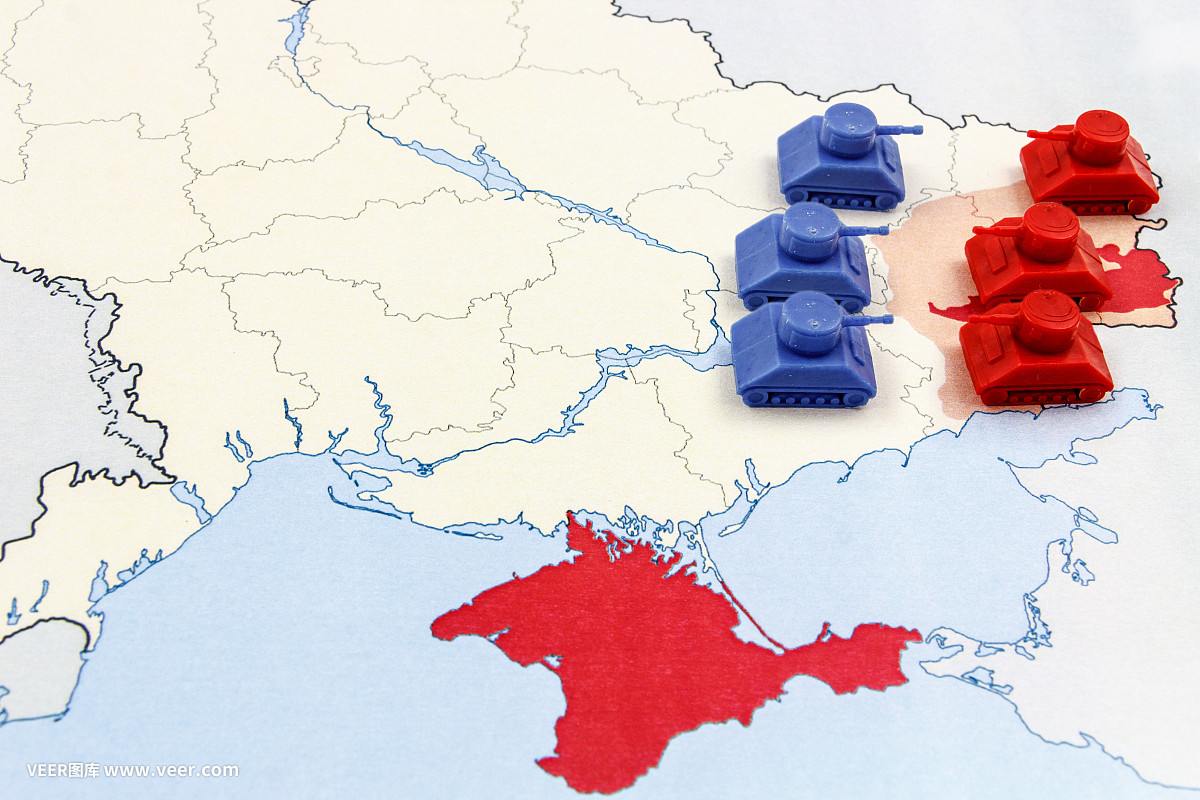

1. Ukraine declares a state of emergency, and the United States and Europe expand sanctions against Russia

Ukraine shifted to combat readiness on Wednesday, declaring a state of emergency starting at midnight on February 24 for 30 days, mobilizing reservists and calling on Ukrainian citizens to leave Russia immediately, warning of an imminent full-scale Russian invasion.

At the same time, the United States and Europe also announced increased sanctions against Russia. U.S. President Joe Biden on Wednesday announced sanctions against Nord Stream 2 AG, the operator of the Nord Stream 2 project. It is a Swiss company whose parent company is the Russian gas giant, Gazprom. Earlier, Germany had announced the suspension of the approval plan for the Nord Stream 2 pipeline.

2. The United States considers releasing the Strategic Petroleum Reserve to deal with soaring oil prices

Foreign media quoted people familiar with the matter as saying that the Biden administration is considering using its emergency oil supply again to cooperate with allies to deal with the surge in oil prices caused by tensions between Russia and Ukraine. There is a "robust dialogue" underway within the government, including potential price point triggers and how to coordinate the release of reserves with other countries, and modelling to determine the size and scope of any possible release.

Market overview

Crude oil situation:

Crude oil fell back after a sharp rise in the U.S. market. WTI crude oil closed up 0.65% at $93.89 per barrel; Brent crude oil closed up 0.9% at $96.88 per barrel;

Macro overview:

The continuous rise in crude oil prices in the early stage drove the price of PTA upwards, and the trading logic of crude oil in the future will shift from storage to accumulation. PTA production capacity has further increased. When the operating rate is around 86%, the weekly production data of PTA has reached a record high. Although the operating rate of polyester is higher than expected, PTA is still accumulating slightly. At present, the operating rate of polyester factories is better than market expectations, but the terminal demand is weak.

Tags :