The excellent market adaptability of China's textile industry under the situation of continuous rise in sea freight and RMB value-added

Jun 06, 2025

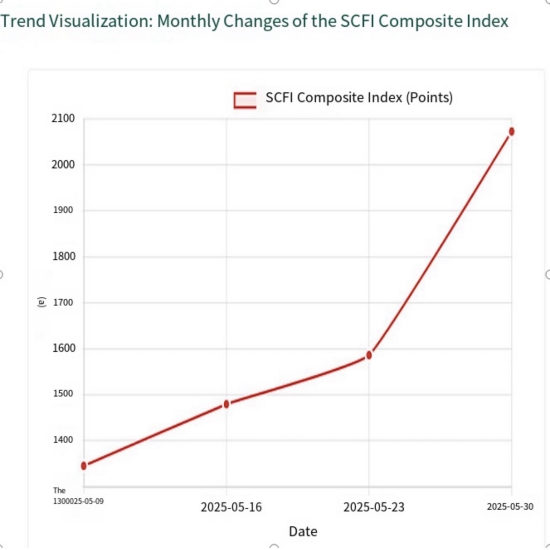

1. Interpretation of Recent SCFI Freight Rate Index Changes Reference materials explicitly highlight that "the shipping market continues to improve" and "freight rates on most routes continued to rise, driving the composite index upward." Behind this trend lie both macroeconomic factors—such as China’s "6.1% year-on-year growth in industrial output from large enterprises" and "8.1% export growth in April"—and the profound impact of specific trade policy adjustments (e.g., eased “"tariff war" tensions") as well as shifts in market supply and demand dynamics. 2. Appreciation across the board The RMB exchange rate trend has stabilized Looking back on the performance of the foreign exchange market in May, the three major quotations of the RMB exchange rate appreciated across the board. On the last trading day of May (May 30), the onshore RMB exchange rate against the US dollar closed at 7.1989, depreciating 0.18% during the day; The offshore yuan closed at 7.2065 against the US dollar, depreciating 0.24% during the day. In May, the onshore RMB appreciated by 1% against the US dollar, and the offshore RMB appreciated by 0.86% against the US dollar. In terms of the central price, the central parity of the RMB against the US dollar was reported at 7.1848 on May 30, compared with the quotation of 7.2014 at the end of April, with a cumulative appreciation of 0.23%. 3. In January to March 2025, the wool import situation in the main wool textile market is still stable 1.) In January to March 2025, the import value of woolen products in the United States totaled 790 million US dollars, a year-on-year increase of 8.7%, of which the import of woolen products from China totaled 130 million US dollars, a year-on-year increase of 9.5%. During the same period, U.S. wool imports from ASEAN and India increased by 30.2% and 22.0% year-on-year, respectively. Regional share of imported woolen products in the United States in January to March 2025 Source: U.S. Department of Commerce's Office of Textiles and Apparel 2). In January ~ March 2025, the import value of Japan's woolen products was 28.6 billion yen (about 200 million US dollars), a year-on-year decrease of 9.4%. In the same period, Japan imported 9.66 billion yen of woolen products from China, accounting for 33.8% of Japan's woolen imports, down 2.4 percentage points. Regional share of imported woolen products in Japan in January to March 2025 Source: Ministry of Finance, Japan 3). In the first quarter of 2025, the import value of EU woolen products (imports outside the EU area) will be 930 million euros (about 1.06 billion US dollars), basically unchanged year-on-year. Among them, imports from China amounted to 310 million euros, accounting for 33.6% of the EU's imports outside the zone, an increase of 3.2 percentage points. Regional share of woolen products outside the EU import zone in January ~ March 2025 Source: Eurostat In summary,with the efficiency of the supply chain and market adaptability,...

View More